HedgeNews Africa sits down with US-based fund manager Rob Price to discuss his macro outlook going into 2022. Price was previously the head of asset allocation at Alexander Forbes Investments for five years from 2016, based in Johannesburg, where he determined asset allocation for the $25 billion institutional pension fund provider.

Price has since relocated to Los Angeles and founded Sound Money Capital, where he manages capital for HNWs and family offices in cryptocurrencies. He has a Masters in Economics from the University of Cape Town and is a CFA charterholder.

Bitcoin is a risk management tool

We are at a critical juncture in the 2020s. Record high valuations, record low interest rates, rising infl ation and numerous social pressures are being forced on to the investment industry, including inequality and environmental degradation. My view is that these challenges are all related and that they are going to be difficult to solve until we start looking at them from a holistic lens. Despite all the volatility, uncertainty and critics, bitcoin and the cryptocurrency ecosystem remain the best solutions available. In this article, I create the macroeconomic context, draw the relationship between a few of these variables, and lay out the investment case for bitcoin and the cryptocurrency ecosystem.

“Everyone loves something for nothing… even if it costs everything” –Stephen King

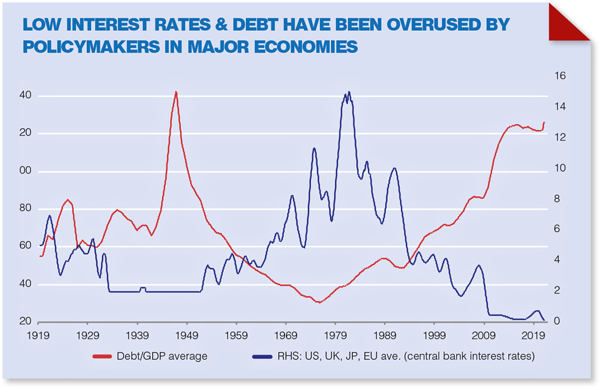

In recent decades, centralised political institutions have allowed societies across the globe, particularly in the West, to live beyond their means. Easy monetary and fiscal policies oversaw expanding governments (budgets, employees and regulation), growing welfare programmes and rising household balance sheets as easy access to credit created the opportunity to spend more at seemingly little cost.

The logic goes along the lines of: “How can we refuse a little more debt when interest rates are so low?” The logic is appealing to households, businesses, and governments alike.

It can be challenging to directly observe the consequences of overusing these economic policies because the relationships are abstracted, but severe consequences certainly exist.

For example, low interest rates cause debt growth, and that capital tends to rush into financial markets. The evidence for this has become obvious since the year 2000 with most financial markets at their highest prices and most overvalued levels on record. This outcome benefits the people who have held those assets, whereas the people who do not hold the assets discover that the assets that they want to purchase (property, equity, etc) have become more expensive. One way to view this directly is by calculating the hours it would take the average US worker to purchase the S&P500.

The graph (right) shows that it takes three times as long for the average US worker to purchase the S&P500 as it did in the 1980s. In other words, there are very unequal consequences of excessively loose monetary and fiscal policies. It is no surprise that societies across the globe are very unequal in the 2020s. Almost every country has hammered interest rates to the floor and racked up as much debt as the markets will stomach.

Over and above inequality, environmental damage, short-term thinking and the growing social conflict are also consequences of the overuse of economic policy. These relationships might not appear obvious today, but consider that the relationship between interest rates and inequality is far more obvious today than it was 10 years ago. I expect that in hindsight the other consequences of monetary and fi scal largesse will become obvious too.

Monetary regime change is a major risk

Corrective policies will not solve these financial, economic and social problems because policymakers ignore the key driver at the centre of the economy – overuse of monetary and fiscal policies. Rather than solve our problems, we accentuate them because political leaders perceive no alternative. Whenever we experience social, economic, political or financial volatility, interest rates are inevitably lowered and debt levels increased because this is perceived as easier than dealing with the underlying problems. And now policymakers have pushed the trend so far that sustainably higher interest rates, with the resulting debt liquidations and short-term economic pain, are politically unpalatable.

Currencies are the release valve for the building economic, financial and social pressure. This trend may not be obvious if one compares euro to the US dollar, and it may also be hidden by CPI infl ation data. But the devaluation of currency is an obvious trend if you compare how much the dollar buys you in London real estate, university education, health insurance, or household food. The assets which people want to buy are increasing dramatically relative to currency.

As central bank and fiscal authorities push the envelope to increasingly unorthodox policies, monetary regime change is inevitable. Monetary regime change may sound like the prediction of a stargazer but consider:

1) national currencies very rarely last longer than 100 years and

2) monetary policy has already changed dramatically in the past 20 years.

Monetary regime change is already under way

The Federal Reserve used to conduct monetary policy through open market operations, then it shifted to Quantitative Easing and more recently the Fed manages liquidity through its Reverse Repo facility.

The current monetary regime is unlike the pre-2000 regime, so perhaps monetary regime change is already under way? The 2030 regime may look remarkably different to today. Investors must think deeply about the implications.

Widespread currency debasement alters the investment landscape

Money is our pricing mechanism, our tool for valuation and the centre of every economic transaction. Money distortion heavily distorts economic and financial calculation. There is a reason the value style has struggled over the past 10 years – value matters less in a world of currency debasement. It matters far more to chase the technology darlings, no matter the valuation. At the extreme, how does one assess a valuation model with a negative discount rate? Every valuation could potentially tend to infinity under a negative discount rate.

Going forward, there will always be periods where excessive global liquidity tightens, and traditional logic reasserts itself. 2022 is likely to be one of those years.

The Fed is planning on raising interest rates, which will place pressure on many of the assets that have inflated sharply over recent years. But tighter central bank policy is only a temporary affair. The Fed will buckle under the pressure of weaker equity markets, weaker economic growth, and/or broader asset price deflation at some point in the next 18 months.

Investors used to seek out the highest yield available in the market, then shifted to seek out the highest growth – but do these lenses apply when real growth is anaemic and interest rates have been hammered to the floor? Perhaps a better question is: how does one protect against monetary regime change risk?

Cryptocurrencies may have an important role to play in the future

Historically, gold was the go-to asset to protect against monetary regime change because societies across the globe have gravitated towards the specific characteristics that make it attractive money: scarce, immutable, verifiable and divisible. Bitcoin is a far superior technology to gold because it is scarcer, digital, borderless, as well as more easily verifiable and divided. Bitcoin’s characteristics imply that it is best suited to become a global reserve asset of the digital age into which we have shifted since the advent of the internet. This is similar to the role gold served in previous generations, or the US dollar serves in the world today.

Obviously, there is a long path towards this outcome but the probability increases with each year that the experiment persists.

Plus, bitcoin already serves this role as the reserve asset of the crypto markets.

The prospect of bitcoin becoming a global reserve asset does not imply that bitcoin needs to replace the dollar and one does not need to believe this outcome to make an allocation. One merely needs to appreciate the differentiated value-add provided by bitcoin, the incredible rise in importance of this asset in merely 12 years, the prospect that this trend continues, and the growing market share captured by this new global reserve asset.

Value and use-cases are tangible despite the early-stage tech

Over and above hedging against monetary regime change, bitcoin and the rest of the cryptocurrency ecosystem present valuable use-cases in the present. Venezuelans and Turks can protect the value of their savings against inflation, Afghanistan women can gain access to bank accounts where they were previously restricted due to gender, political opposition in the Ukraine and Nigeria can gain access to global funding networks to oppose their oppressive governments, and expats from El Salvador can send remittances to their family at home in a far cheaper, secure and faster manner than before. It is a big mistake to think that these technologies are not useful in the present.

Is it worth the volatility?

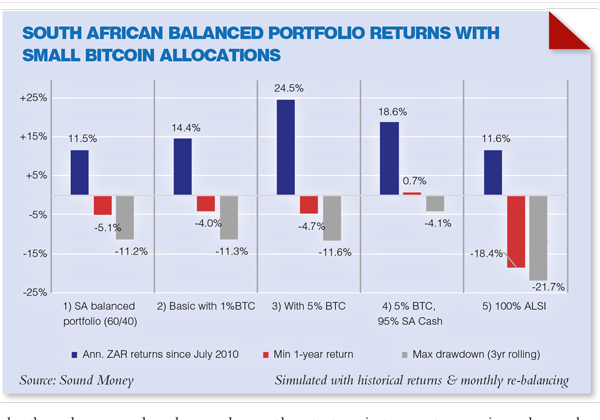

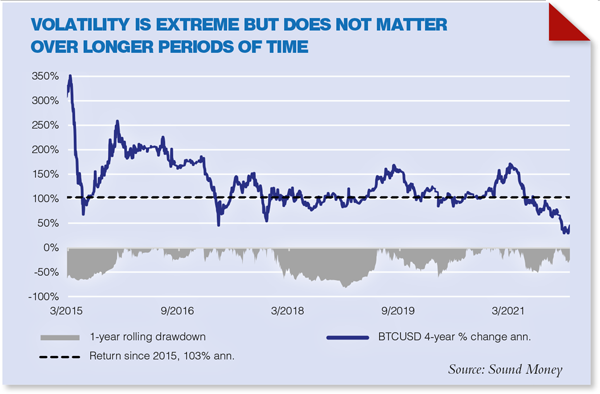

Asset volatility is only a problem if that asset’s weighting in a portfolio is too high for the specific client. There is a percentage allocation to bitcoin within a portfolio context that could be suitable to even the most conservative of investors.

For example, a 1% allocation to bitcoin within a traditional 60:40 ALSI-ALBI portfolio increased returns by approximately 3% but had almost no impact on drawdowns.

If one pulls back the lens far enough, the volatility of an investment in bitcoin has become irrelevant. Bitcoin has never returned less than 30% annualised over any four-year rolling period. So, volatility can easily be mitigated through the appropriate strategy.

Volatility also presents opportunities for active management and outperformance versus the underlying but that is certainly not for the faint hearted and not recommended to those without investment experience.

Short-term headwinds but long-term potential intact

Long term, bitcoin continues to offer incredible return potential. Newcomers are prone to think that elevated past returns imply that future returns will be muted. Clearly there is some logic to this argument. Growing institutional interest will likely dampen bitcoin volatility at the margin. That being said, a monetary network is more valuable the bigger it becomes because there are more nodes to which each participant can connect, more buyers, sellers, merchants, insurers etc. A similar logic holds with tech networks like Amazon, Google and Facebook.

Seen through this lens, incredible investment returns are still possible for bitcoin.

Over the shorter term, the outlook is heavily impacted by the Fed’s monetary policy trajectory. The Fed is planning to hike interest rates and remove quantitative easing in 2022. It is worth bearing in mind that if the Fed truly normalised monetary policy, removing QE and raised interest rates to historical norms, the argument for bitcoin would diminish substantially.

But find me a government or central banks with the stomach for true normalisation, positive real interest rates and debt write-downs? China’s Xi Jinping has already pleaded with the Fed to refrain from tightening policy. Bitcoin will face headwinds while the Fed is tightening but will likely respond violently to the upside when the Fed finally capitulates and reverses tightening.

Focusing on the core protocols and principles is the best way to manage risk

It is most prudent for newcomers to focus on the value proposition offered by bitcoin’s scarcity, security and decentralisation.

It is easy to gloss over an allocation to a potential reserve asset of the future because it seems too simple, but investors should avoid this trap.

There are fascinating innovations across the crypto markets as developers apply the concept of digital scarcity to broader financial applications, art, entertainment and gaming. Many investors extract incredible returns from investments into these protocols, but newcomers must be aware of the riskier nature of these investments.

The use-cases are usually more tenuous than bitcoin’s and hence expose investors to greater risk. The risk-return trade-off is something I expect investors will be more sensitive to in 2022 than 2021 due to the Fed’s tightening trajectory, ie: lower risk assets within the crypto ecosystem, like bitcoin, will likely outperform higher risk assets this year.

Incumbents under pressure as crypto steams ahead

Unprecedented monetary debasement is the elephant in the room. Apart from its pernicious consequences on almost every aspect of our lives, it permeates each and every asset class into which we invest.

Savvy investors must protect portfolios against monetary regime change risk. Bitcoin has proven itself as one of the best ways in which to solve this problem. As the consequences of monetary and fiscal profligacy become more obvious, the pressure will mount to find solutions.

Bitcoin’s robustness and resilience to the external attack implies that it will remain on the table as a potential solution. Incumbents in finance, banking and regulatory bodies are sceptical of this new technology because it does not align with their conventional understanding of the world. But this unfamiliarity is a major threat because the elephant in the room is not going away. The pressure to understand bitcoin and the problems it solves will mount, no matter the volatility that 2022 brings. Copyright. HedgeNews Africa – January 2022.