Strong line-up for 13th annual HedgeNews Africa Awards

Cape Town: The Steyn Capital SNN Retail Hedge Fund won the prestigious Fund of the Year award at HedgeNews Africa Awards 2021, where a total of 13 awards were presented across various categories.

The Steyn Capital SNN Retail Hedge Fund, managed by Andre Steyn at Steyn Capital Management, delivered a net 51.63% return in 2021 on a Sharpe ratio of 4.38.

Steyn Capital had an exceptional 2021, taking home a total of three trophies on the night. Its Steyn Capital SNN QI Hedge Fund won best long/short fund, the industry’s biggest category, with a return of 51.05% and a Sharpe ratio of 4.95, while its Steyn Capital Africa Fund took the honours in the pan-Africa category, with a return of 32.23% and a Sharpe ratio of 2.28.

Another multiple winner was Alexander Forbes Investments, which took double honours. Its AF Investments Performance QI Hedge Fund of Funds won for best Fund of Funds in 2021, with a return of 21.92% and Sharpe ratio of 6.35, while the AF Investments Performance QI Hedge Fund of Funds took best fund of funds over five years, with an annualised return of 10.26% and Sharpe of 0.81.

In the market neutral and quantitative category, the All Weather H4 Market Neutral Retail Hedge Fund was victorious with a net gain of 28.42% and a Sharpe ratio of 5.28.

In the fixed income category, the Oakhaven SNN Strategic Fixed Income QI Hedge Fund won top honours with a return of 22.71% and a Sharpe ratio of 3.83.

In the multi-strategy category, the Blue Quadrant Capital Growth Prescient RI Hedge Fund was the clear leader, with a gain of 99.46% and Sharpe ratio of 6.12.

Amongst global strategies, the Optis Global Opportunities Fund won for the second consecutive year, with a stellar return of 151.13% and a Sharpe ratio of 2.69.

Amongst specialist strategies, the winner was the property-focused Catalyst Alpha Prescient QI Hedge Fund, with a 2021 return of 32.69% and a Sharpe of 3.41.

In the longer-term categories, the Fairtree Assegai Equity Long Short SNN QI Hedge Fund won for best single-manager performance over five years, its fourth consecutive win in this category, with a net annualised gain of 21.67% on a 0.53 Sharpe ratio.

The Polar Star SNN QI Hedge Fund won for best single-manager fund over 10 years – again a fourth consecutive win – with an annualised return of 22.17% and a Sharpe of 1.08.

For best fund of funds over 10 years, the Old Mutual Multi-Managers Long Short Equity FoHF took the trophy for the fourth consecutive year, with a net gain of 11.38% on a Sharpe ratio of 0.89.

Now in their 13th year, the Awards measured the best risk-adjusted returns of funds across 13 different categories. They are based on monthly data submitted to the HedgeNews Africa database, which includes South African hedge funds as well as other pioneering strategies applied across the broader African markets.

The Awards use an established methodology and independently verified data submitted to HedgeNews Africa, the region’s leading independent publisher focused on the hedge fund and alternative asset management industries.

“Many funds in our universe delivered exceptional returns in 2021, while protecting against downside risks, extending the industry’s convincing track record during both up and down markets,” notes Gwyneth Roberts, the publisher of HedgeNews Africa.

In total, 58 nominations were given across 13 categories, with the one-year awards ultimately going to those funds with the top return provided their Sharpe ratio was within 25% of the top Sharpe amongst the nominees – a method to appraise consistency of returns.

The annual awards were hosted in partnership with top industry service providers, namely Investec, RMB, Absa and Peresec, and presented at a gala dinner in Cape Town.

The final nominees are: (winners in bold)

Long/Short Equity

All Weather H4 Performance Retail Hedge Fund

Laurium Aggressive Long Short Prescient QI Hedge Fund

OysterCatcher RCIS Long Short Retail Hedge Fund

Steyn Capital SNN Retail Hedge Fund

Steyn Capital SNN QI Hedge Fund

Visio SNN Occasio QI Hedge Fund

Market Neutral and Quantitative

Abax Bao NCIS Market Neutral RIF

All Weather H4 Market Neutral Retail Hedge Fund

X-Chequer SNN Diplo QI Hedge Fund

X-Chequer SNN Market Neutral QI Hedge Fund

Multi-Strategy

Aylett Prescient QI Hedge Fund

Blue Quadrant Capital Growth Prescient RI Hedge Fund

Coronation Multi-Strategy Arbitrage Hedge Fund

Rozendal Worldwide Flexible Prescient QI Hedge Fund

Fixed Income

Abax Fixed Interest Prescient RI Hedge Fund

Acumen AcuityOne SNN Retail Hedge Fund

Fairtree Fixed Income Fund

Oakhaven SNN Strategic Fixed Income QI Hedge Fund

Pan-Africa

Allan Gray Africa Equity Fund

Allan Gray Africa ex-SA Equity Fund

Coronation Africa Frontiers Fund

Steyn Capital Africa Fund

Fund of Hedge Funds

AF Investments Focus QI Hedge Fund of Funds

AF Investments Performance QI Hedge Fund of Funds

Edge RCIS Portable Alpha 1 QI Hedge Fund

Old Mutual Multi-Managers Long Short Equity FoHF

Global

Catalyst Alpha Global Real Estate Fund

Optis Global Opportunities Fund

Visio Salveo Global Long/Short Fund

Specialist strategies

Alt Re SNN Select Opportunity QI Hedge Fund

Catalyst Alpha Prescient QI Hedge Fund

Prime Reitway Leveraged Global Property RI Hedge Feeder Fund

Polar Star SNN QI Hedge Fund

Five-Year performance (Single Manager)

Anchor Accelerator SNN QI Hedge Fund

Greenpoint Specialised Lending Private Credit Fund

Fairtree Assegai Equity Long Short SNN QI Hedge Fund

Fairtree Wild Fig Multi Strategy SNN QI Hedge Fund

Polar Star SNN QI Hedge Fund

Steyn Capital SNN QI Hedge Fund

Five-Year performance (Fund of Funds)

AF Investments Focus QI Hedge Fund of Funds

AF Investments Moderate QI Hedge Fund of Funds

AF Investments Performance QI Hedge Fund of Funds

Old Mutual Multi-Managers Long Short Equity FoHF

Ten-Year performance (Single-Manager)

Catalyst Alpha Prescient QI Hedge Fund

Greenpoint Specialised Lending Private Credit Fund

Fairtree Assegai Equity Long Short SNN QI Hedge Fund

Fairtree Wild Fig Multi Strategy SNN QI Hedge Fund

Peregrine Capital High Growth H4 QI Hedge Fund

Polar Star SNN QI Hedge Fund

Ten-Year performance (Fund of Funds)

AF Investments Focus QI Hedge Fund of Funds

AF Investments Performance QI Hedge Fund of Funds

Old Mutual Multi-Managers Long Short Equity FoHF

Fund of the Year

All Weather H4 Performance Retail Hedge Fund

Blue Quadrant Capital Growth Prescient RI Hedge Fund

Laurium Aggressive Long Short Prescient QI Hedge

Oakhaven SNN Strategic Fixed Income QI Hedge Fund

Steyn Capital SNN Retail Hedge Fund

Steyn Capital SNN QI Hedge Fund

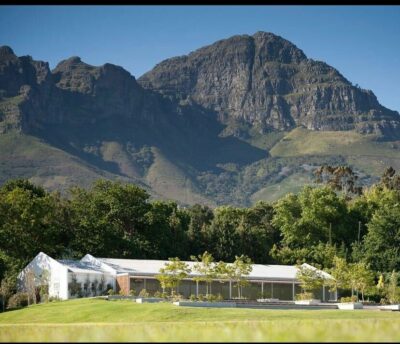

The 2021 Awards were held in the Cape winelands at the beautiful Laurent, Lourensford, Somerset West.