A volatile start to the year brought a wide range of returns from South African hedge funds in January, with the HedgeNews Africa South Africa Single Manager Composite adding 0.29% for the month while the FTSE JSE All Share Index added 0.86% and South Africa’s All Bond Index gained 0.85%.

Global markets were largely negative, with the MSCI World Index losing 5.34% for the month and the MSCI Emerging Markets Index dropping 1.93%.

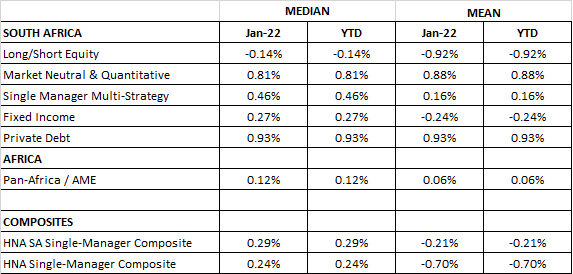

South African market neutral and quantitative funds added a median 0.81% in January, while single-manager multi-strategy funds added a median 0.46% for the month. Long/short equity funds had a tough month in choppy markets, dipping -0.14% on a median basis, while fixed income funds gained a median 0.27%. Property-focused strategies and global funds had a tough January, ending in the red, while private debt funds were the strongest category, delivering a median 0.93%, and pan-African portfolios edged 0.12% higher. Copyright. HedgeNews Africa – February 2022.